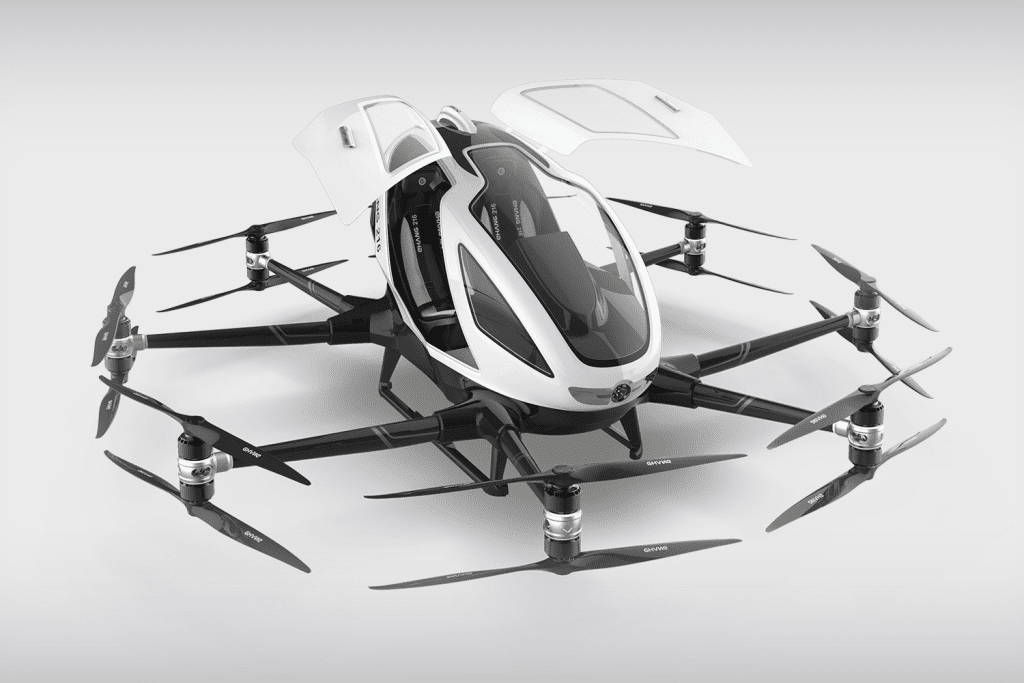

On March 27, the Ministry of Industry and Information Technology, along with three other departments, issued a joint statement that reignited discussions about the low-altitude economy. According to a research report by Debon Securities, airworthiness certification is a prerequisite for the commercial operation of eVTOLs. On April 7, EHang announced that its EH216-S received the first production certificate issued by the Civil Aviation Administration of China (CAAC). Currently, products from both EHang and Autoflight have received airworthiness certification from the CAAC.

eVTOLs are poised for takeoff. According to the “China Low-Altitude Economy Development Research Report (2024)” by CCID Consulting (hereinafter referred to as the “Report”), the scale of the eVTOL industry in China reached 980 million RMB in 2023 and is expected to grow to 9.5 billion RMB by 2026.

Certification Expected to Accelerate

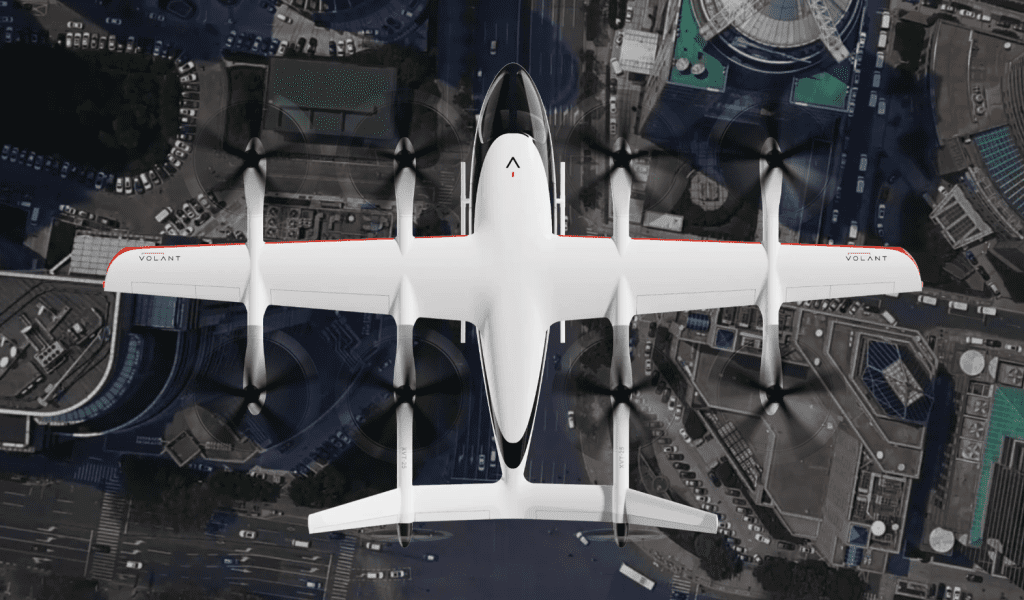

According to CCID Consulting, the main eVTOL manufacturers currently include EHang, TCab Tech, Zero Gravity, Volant, Autoflight, XPeng, Pantuo Aviation, Autoflight Future, and Volocopter.

Several companies among those mentioned have already submitted applications for airworthiness certification. According to incomplete statistics from Shell Finance reporters, from November 2022 to January 2024, the Civil Aviation Administration of China (CAAC) accepted type certificate applications for Autoflight Future’s AE200, Volant’s VE25-100, TCab Tech’s E20, and Autoflight Future’s M1B.

According to relevant laws and regulations, airworthiness certification primarily includes three types: Type Certificate (TC), Production Certificate (PC), and Airworthiness Certificate (AC).

Each of these certificates represents different stages. “The CAAC will issue a Type Certificate when it deems the aircraft meets safety and reliability standards, granting market access to the product. The next step focuses on the production system, and if it meets standards, a Production Certificate will be issued, allowing for mass production,” explained Gao Yuanyang, Director of the General Aviation Industry Research Center at Beihang University.

“The most challenging part is the TC review, which is also the core difficulty of eVTOL airworthiness,” Zeng Tao, Chief Analyst of the Power Equipment and New Energy Industry at CICC Research, told Shell Finance reporters. “The TC review process is rather tedious, generally taking 3 to 5 years, while the PC and AC are relatively simpler, with the PC typically taking 3 to 6 months for approval.”

Qin Rui, Director of the Low-Altitude Economy and Low-Altitude Transportation Research Center at China Civil Aviation University, pointed out that the difficulty in domestic eVTOL airworthiness certification lies in the novel technical characteristics, large quantities, and numerous models, presenting new demands and challenges for airworthiness certification. “The airworthiness certification of new types of aircraft like eVTOL requires joint research and the establishment of new standards by the CAAC, the industry, and even manufacturers,” Gao Yuanyang added.

Currently, among domestic eVTOL products, only EHang’s EH216-S has all three certificates, obtaining the “ticket” for commercial operation. Additionally, Autoflight’s V2000CG has also announced its acquisition of a Type Certificate.

Regarding the current airworthiness certifications obtained by domestic eVTOLs, Qin Rui noted that these are initial airworthiness certifications for specific models, representing that the aircraft can be put into service. Subsequent continuous airworthiness checks, which ensure the aircraft remains airworthy after a period of use through maintenance and inspections, are still necessary.

Companies Continue to Explore Commercialization Directions

On March 27, the Ministry of Industry and Information Technology, along with three other departments, jointly issued the “Implementation Plan for the Innovative Application of General Aviation Equipment (2024-2030),” which requires new general aviation equipment to achieve commercial applications in urban air transportation, logistics distribution, and emergency rescue by 2027.

“The first to possibly achieve commercial implementation will be cargo scenarios, which have relatively lower risk, but the ultimate application will be more in passenger transportation,” said Qin Rui. Using eVTOLs over 100 kilograms as an example, he explained that cargo might account for only about 15%, while passenger transportation could account for 70%, with the remainder being used for specific scenarios. In his view, using eVTOLs for commercial cargo transport currently poses no significant issues.

According to Qin Rui’s observation, different companies are exploring application scenarios through various technical routes. After reviewing the six models that have obtained or have been accepted for type certification, the reporter found that the ratio of passenger to cargo models is 3:2, with one model being a dual-purpose passenger and cargo aircraft.

After obtaining all three certificates, EHang will first invest in tourism applications. On April 10, EHang’s Vice President He Tianxing told Shell Finance reporters that the commercial operation of the EH216-S will start with low-altitude tourism this year, creating a low-altitude economic operation model in cities like Guangzhou, Shenzhen, and Hefei before gradually expanding nationwide. Over the past two years, the EH216-S has completed tens of thousands of safe test flights in low-altitude tourism scenarios.

The “Report” predicts that 2024 will see the first wave of commercialization in the eVTOL industry. However, interviewed experts believe that large-scale commercial operations of eVTOLs will still require some time, possibly 5 to 10 years, with manned operations potentially taking 2 to 3 years.

Costs Hundreds for a Single Ride, Developing “General” Aircraft to Reduce Costs

What factors might limit the commercial progress of eVTOLs? In this regard, Qin Rui raised the issue of cost and price.

The cost per eVTOL trip is high. According to estimates in the “Passenger eVTOL Application and Market White Paper” jointly released by Southern Airlines General Aviation and Volant, for the route from Shanghai Lingang to Hongqiao Transport Hub, at the early stage of eVTOL operation and calculating a 10% operating profit, the total one-way fare would be 1188 yuan, with a per-seat price of 297 yuan.

The market price for a complete aircraft, taking EHang’s EH216-S as an example, is 2.39 million yuan per unit in the Chinese market, and 410,000 USD per unit in the international market. According to He Tianxing, as of 2023, over 200 units of EHang’s EH216-S have been sold and delivered.

“eVTOL is a technology-driven industry.” Qin Rui believes that developing classic aircraft with a broad range of applicable scenarios and easy scene switching is conducive to cost-sharing. “Currently, many configurations have significant limitations in application scenarios. Configurations with limited use scenarios are equivalent to customization. Customization is bound to be expensive, and the usage volume will inevitably be low.” He predicts that there will not be many classic aircraft remaining in the future.

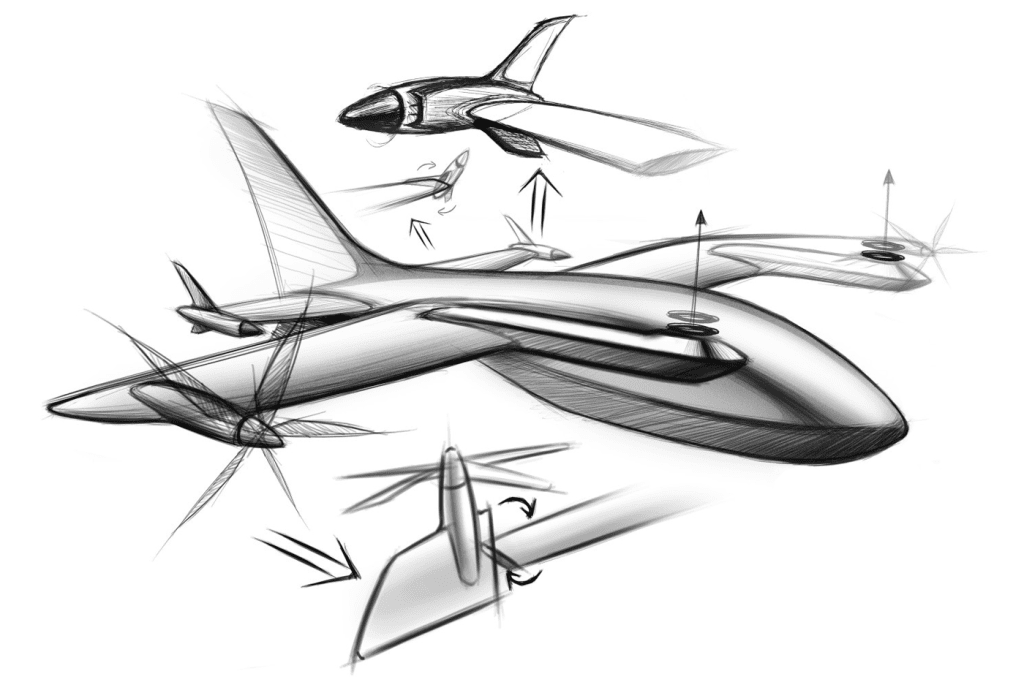

From the current trend of domestic capital, tilt-rotor and multi-rotor configurations are more favored by capital. The “Report” indicates that in 2023, investment events in the Chinese eVTOL field mainly focused on the tilt-rotor configuration; from the disclosed financing amounts, companies engaged in the multi-rotor configuration technology route received the largest investment amounts in complete aircraft manufacturing.

Additionally, in Qin Rui’s view, the construction of take-off and landing airports and low-altitude airspace has a relatively small impact in the early development stage of the eVTOL field. However, as large-scale deployment and high-density operation stages arrive, infrastructure construction “must keep up.” He suggests that the eVTOL field should plan infrastructure in advance, make thorough land and airspace planning, and integrate with existing facilities to avoid waste.

“The eVTOL infrastructure needs public funding investment and should be constructed as public infrastructure.” He also believes that infrastructure open to many low-altitude users, including communication, navigation, surveillance, and meteorological facilities, should also be handled by the government, “with appropriate charges,” but it is inappropriate for it to become entirely spontaneous private behavior, “because its public characteristics are significant.”

Debang Securities research reports show that the current main body of low-altitude economic infrastructure is general airports. According to statistics from the General Airport Information Platform, as of January 10, there are 105 certified general airports and 348 registered general airports in China.

What industry support will eVTOL commercial operations bring once they mature?

“With the rollout of infrastructure construction, it not only brings benefits to upstream planning, design, construction, and material equipment suppliers but also accelerates the large-scale deployment process of eVTOLs.” According to Qin Rui’s research estimates, investing 1 yuan in a complete eVTOL aircraft can drive related industries to create value up to 7 yuan.

In addition to the derivative chain, eVTOLs will also interact with other future industries. For example, Gao Yuanyang believes that eVTOLs will promote the mutual development and integration of traditional general aviation products with artificial intelligence, new energy, and air-ground interconnection.

“Intelligence and connectivity are crucial for the large-scale deployment of eVTOLs,” Qin Rui stated. Small-scale meteorological observation and forecasting are difficult, and the operating environment is complex and diverse. “Using integrated ‘perception-computation-control’ technology can enhance the aircraft’s automatic risk identification and active air defense capabilities, simplifying many problems.”

References:

https://m.bjnews.com.cn/detail/1712803200129977.html

http://www.news.cn/tech/20240402/1854417fb84a4b6d8322410c2eca31db/c.html

https://www.gov.cn/zhengce/zhengceku/202403/content_6942115.htm

http://www.volantaerotech.com/news/20240506

https://www.autoflight.com/en/news/shenzhen-zhuhai-route

Leave a Reply